This is what I have learnt so far from my cash budgeting journey and I hope you too can pick something up here for yourself to help you on your journey.

1. Intentional Spending

Cash budgeting forces you to plan and think ahead about how much money you have and where it will go. By physically separating cash for different categories, you become more mindful of your spending choices. This intentionality leads to better financial habits, as you are less likely to spend impulsively when you know the cash envelope for that category is limited.

2. Clear Financial Boundaries

Each cash envelope sets a clear limit for how much you can spend in a given category, whether it’s groceries, entertainment, or dining out. Once the money in the envelope is gone, you’re done spending. This teaches discipline and helps prevent overspending, which can be easier to fall into when using cards or digital payments.

3. Visual Accountability

With cash budgeting, the money is physically in front of you, making it harder to ignore your financial limits. This visual accountability creates a tangible connection to your spending habits, which can help curb unnecessary purchases. The act of physically handing over cash also makes you feel more connected to the expense compared to swiping a card.

4. Budget Flexibility and Adjustments

If one category runs out of cash, you have to make a conscious choice about whether to take money from another envelope, thus reinforcing prioritization. Cash budgeting allows you to learn how to be flexible within your budget and adjust based on your real needs, which is a critical financial skill.

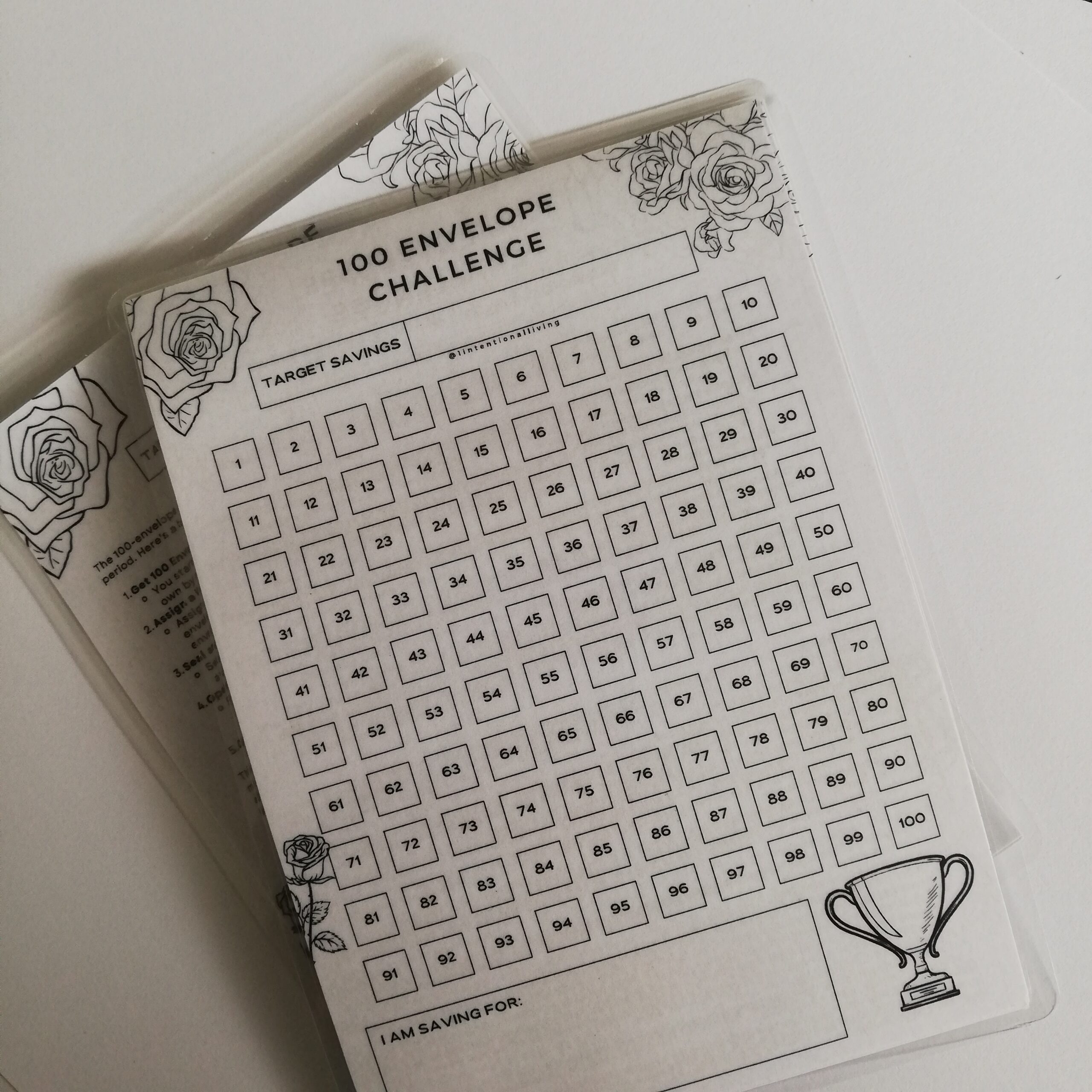

5. Savings Discipline

The system makes saving easier by setting aside specific amounts in envelopes (or in a budget binder). Combined with challenges like the Big five savings challenge, cash budgeting can foster a habit of consistent saving, teaching the importance of preparing for emergencies and future goals.

These lessons collectively build long-term financial discipline and a better understanding of money management, making it easier to achieve both short- and long-term financial goals. They truly did not come easy as I continuously learn as I go. So, be patient with yourself and intentional with your money.