The idea of having money in the house used to scare me at first. But then I figured that I could have a little in the house and have larger amounts in the bank. And, when I do challenges, I take large amounts to the bank and use cash replacement notes. I also do the same for debits, utilities and such accounts. I have found a place in the hybrid system that works for me and I know that someone out there is still afraid to start. So I thought we could explore 7 most common reasons you might shy away from cash budgeting and try to show you a few possible solutions that can help you find what works for you.

1. Fear of Inconvenience

Many believe managing cash is cumbersome in a world dominated by digital payments. It feels outdated to carry envelopes of money.

Solution: Start with a hybrid system; use cash for discretionary spending like groceries and entertainment while keeping fixed expenses like rent or utilities digital. This reduces the inconvenience while still offering the benefits of cash discipline.

2. Loss of Control with No Credit History Tracking

Some people worry that using cash exclusively might impact their ability to build a good credit score.

Solution: You don’t have to eliminate credit cards entirely; use them for specific, planned purchases and pay them off in full every month (if you can). This helps maintain credit while avoiding the pitfalls of over-reliance on credit cards.

3. Security Concerns

Carrying cash may feel unsafe, especially in areas where theft or loss is a concern.

Solution: Only carry the exact amount you plan to spend that day or week. Keep larger savings safely stored at home or in a bank account until needed for your envelope allocations.

4. Lack of Flexibility

People fear that cash budgeting doesn’t allow for flexibility when unexpected expenses arise.

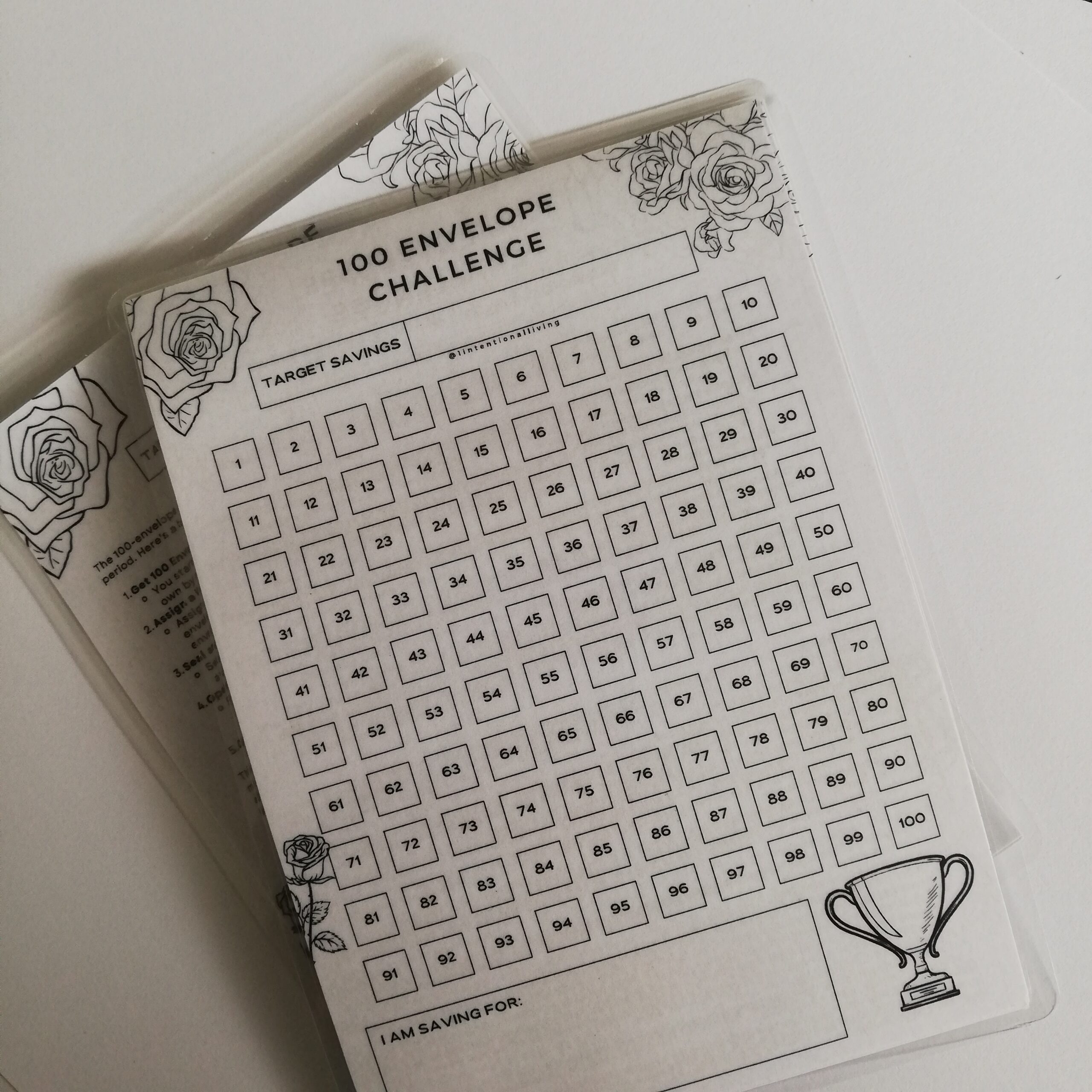

Solution: Build emergency envelopes or sinking funds for irregular expenses like car repairs or medical bills. This way, you can stay flexible within the structure of cash budgeting without feeling restricted.

5. Feeling Overwhelmed

The idea of manually budgeting each expense with envelopes can feel overwhelming, especially for those new to budgeting.

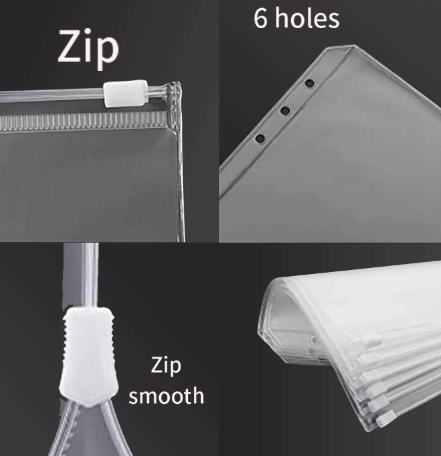

Solution: Start small. Begin by budgeting just one or two categories with cash, such as entertainment or groceries, and expand as you become more comfortable. Use tools like budget binders to track progress and stay organized.

6. Difficulty Breaking Spending Habits

Some find it difficult to transition from the ease of swiping a card to handing over physical cash, which makes spending more tangible.

Solution: Focus on the psychological benefits. Physically seeing cash leave your hand can help you become more aware of your spending habits and lead to better financial decisions over time.

7. Fear of Failure

Many avoid cash budgeting because they fear they won’t stick to it or will mess up.

Solution: Understand that cash budgeting is a learning process. Mistakes happen, and that’s okay. You can always readjust your envelopes mid-month and refine your approach. The key is to start and keep improving.

By addressing these fears with practical solutions, you can overcome the initial hurdles and begin using cash budgeting as a path toward financial freedom. This system teaches discipline, control, and accountability; key habits for long-term financial health. It will be bumpy for the first few months but as you get the hang of it, things will go smoothly.