How to Balance Cash and Digital Payments

Managing finances can feel overwhelming, but using a cash budgeting system can help you gain control, even when most bills are paid digitally. A hybrid system, combining digital payments with cash envelopes, offers flexibility and structure.

How to Get Started with Cash Budgeting

Begin by categorizing your expenses. Essential recurring payments like debits, medical bills, insurance, and car payments are often best managed through digital banking or automatic transfers. This ensures timely payments and simplifies tracking. For other expenses like groceries, entertainment, and dining out, the cash envelope system works wonders. By setting aside a fixed amount of cash in labeled envelopes for each category, you create physical boundaries that prevent overspending.

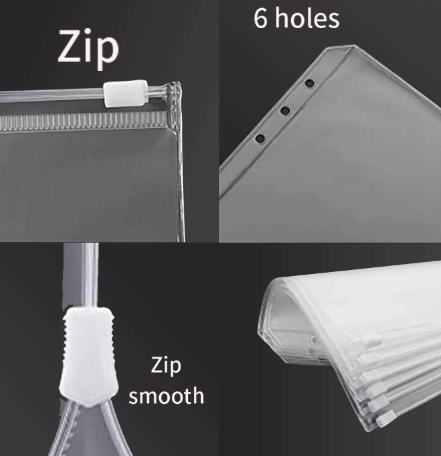

Organizing with a Budget Binder

A budget binder is a useful tool to keep your finances in check. In the binder, track your income, categorize your expenses, and write down the amount allocated for each envelope. You can also include sections for savings goals, debt repayment, and emergency funds. By regularly updating your binder, you can monitor where your money is going and make adjustments if needed.

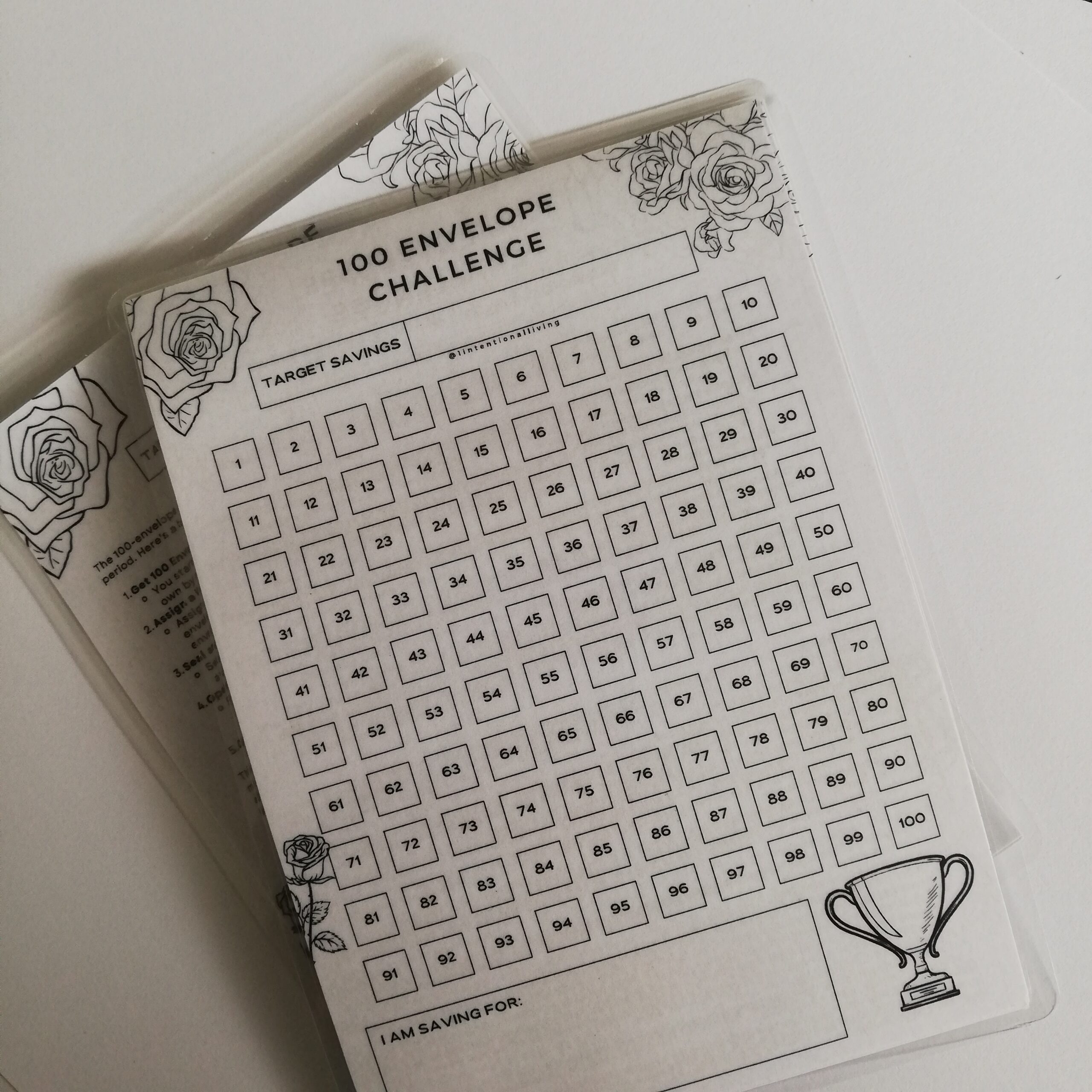

Include Savings Challenges

To boost your savings, consider joining savings challenges. These could be as simple as the 15 Envelope Savings Challenge, where you save an increasing amount in each envelope, or the Big Five Envelope Challenge, where you save specific cash notes per envelope each time. These small, consistent efforts can add up over time and help you meet goals like funding an emergency fund or paying off debt faster.

Using a combination of digital payments, cash envelopes, and a budget binder ensures you stay organized and mindful of your financial habits, while savings challenges keep you motivated toward long-term goals.